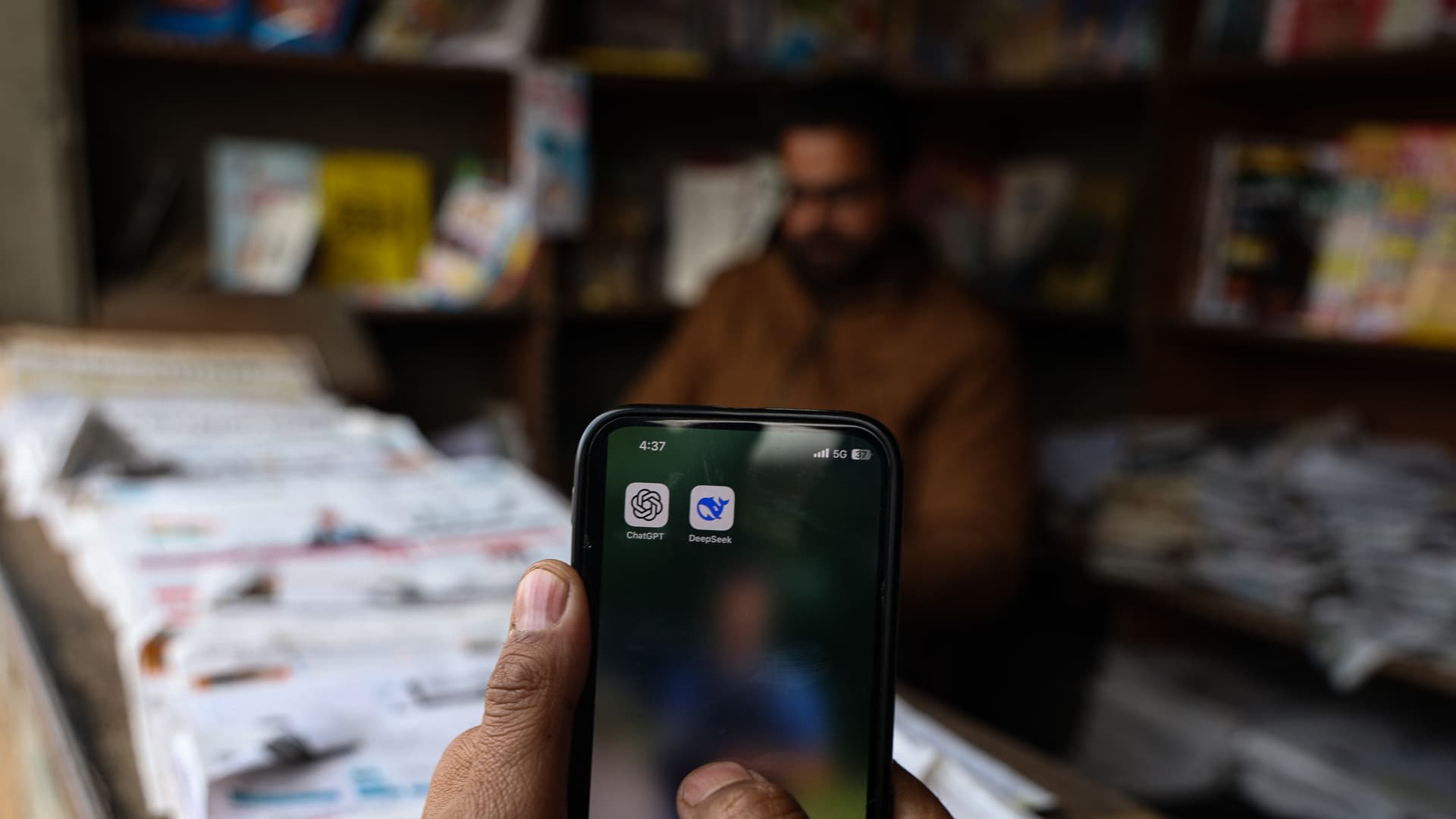

AI AI AI applications and Deepseek on a user’s phone in Sopore, Jammu and Kashmir, India, February 5, 2025

Nasir Kachroo | Nurphoto | Pictures of getty

This report is from this week’s CNBC’s « INSIDE INSIDE » that gives you timely and interesting news and market comments over the emerging center and large companies behind its meteoric increase. Like what you see? You can subscribe to -US Here.

The great story

China swing the markets earlier this year when its Deepseek startup revealed a cheaper and more efficient artificial intelligence model.

With the growth history of India and the population experienced in more prominent technology, to what extent does the country come from its own Openai or Anthropic at a lower cost?

We sat down with Kunal Bahl, a well -known businessman and investor. He co -founded the Titan Capital Risk Capital Firm and is better known for the Foundation of India Unicorn Snapdeal, a popular online market. He is also a judge at Shark Tank India.

« Given the success of India in creation, deploying and climbing public digital infrastructure … The appearance of an Indian Deepseek will probably be through private public collaboration over the next 4-5 years, » said Bahl.

Bahl emphasized some initiatives that could help India build their own language models with global attractiveness.

Manufacturers chips

First, the manufacture of chips where India’s efforts are collecting steam.

India’s Secretary of Commerce, Pyush Goyal, told me last October that India is going to rhythm pace It manufactures its first chip in two years. Separately, we reported earlier this year that Reliance Industries is in the process of constructing what the CEO Mukesh Ambani hopes to be the largest data center in the world of Gujarat.

The push of India to make and design avant -garde chips is not easy. Just look at the challenges that Intel has in the construction and production of AI tiles in the United States

However, India has gained the support of the US semiconductors. Micron and AMD are among U.S. Chips companies investing in the country. Nvidia’s CEO, Jensen Huang, visited Mumbai in 2024, during which he announced a collaboration with Reliance Industries in the research and development of the IA. Huang also promised Reliance Access to the last Nvidia Blackwell chip.

« These collaborations recognize the important role that India will play in the global ecosystem and seek to take advantage of the advantage of the first movement, aligning with strong national conglomerates, » said Bahl.

Building more chips in the country can be a way to limit the impact of U.S. restrictions on chip exports.

Days before former President Joe Biden Marxés implemented the diffusion standard, which could restrict not only China, but also several countries to buy high -performance graphic processing units in the United States, including India. This rule will come into force this spring. President Donald Trump has the power to reverse him, but he has not indicated if he will.

Innovation of the IA

As for AI, Bahl added that innovation may come from the great Indian conglomerates such as Reliance and Tata that build their own multimodal LLM for specific use of industry. Reliance Jio, Tata Electronics, Adani Group, TCS and Infosys are among the heavy weights of India that Bahl said they are quickly becoming the hyperscalers of India.

With the closed China Market, North -American companies have shown to help build the Ai Ecosystem of India. Openai’s founder and CEO Sam Altman was in India in early February when he met with Minister Ashwini Vaishnaw. Vaishnaw published in X that the two discussed Openai’s interest in collaborating on India’s goal « Creating the entire AI stack: GPU, model and applications ». Altman shared that India is currently the second largest in Openai Market in terms of users.

Bahl believes that government programs such as the « Ai Mission of India » assigned 103 billion rupees ($ 1.2 billion) for five years to strengthen the country’s AI capabilities will also play a key role.

He acknowledged that while the financing of the AI of India is growing, « it is still much lower than the United States and China. »

The investigation of Bernstein’s Indian CAP is more cautious. He said that India’s lack of investment in home technology makes it less likely to survive the Ai Battle.

« The creation of deep technological capacities has not been a priority (for India), as the products of American technological giants, which are now led by several Indian CEOs, have been easily available.This contrasts with China, which has created rivals for these companies in all areas from micro-blogging to EVS in Ai models. The prohibition of foreigners; developing their own approach to the Internet age, and now is too late. «

By the way, being soon does not always guarantee leadership.

« Ai models continue to childbirth and is still a blue ocean.

The other risk, according to experts, is the IA to displace jobs in the technology sector of India. Unemployment is high in the country and adding more productivity tools such as AI could risk the weak Indian labor market, said Akhil Gupta, former Blackstone India head in CNBC.

The economic context of India and young labor force should position the country as a leader in disturbing technologies, but industry experts agree that if the emerging market does not divert enough time, resources and talent to find out its role in the AI landscape, it may be a victim.

« India is far behind to develop its own Deepseek version, but what I can say about talking to several executives is that India has awakened in the challenge and is inspired by the success of China, » added Gupta.

We will be looking and waiting.

You need to know

The Indian government approves a new electronic manufacturing scheme. The initiative, endorsed by funds of $ 22,919 ($ 2.67 billion), was approved by the Union Office Friday and aims at Build self -sufficiency in the country’s electronics sector.

The Indian Reserve Bank accelerates open market operations. During their exercise 2025, India Central Bank bought Indian government values This was a maximum of four years. Its movement emphasizes the importance of managing liquidity in the financial system in the midst of a decrease in national economic growth and an uncertain international environment.

Cutted rates as part of trade concessions in the United States From January, India has been reducing taxes imposed on US importssuch as motorcycles, whiskey and Ethernet switches. In a more significant way, the objective of equating the South Asian nation, which imposes the digital services offered by non-resident companies, was abolished.

The luxury sector of India is booming. He currently values $ 8 billion, the Luxury retail market is expected to grow a 75% explosive And will be worth $ 14 billion by 2032. The factors that drive this increase include that brands and brands grow of high clean value and adapt their offers to adapt to Indian tastes.

Singapore Merica goes with an agreement with Haldirams. By virtue of the agreement, Singapore State Investment Fund will Acquire a capital participation in HaldiramsIt announced on Sunday the Indian pastry company. The agreement with the support of Haldiram’s expansion abroad and is expected to close soon.

What happened in the markets?

Indian stocks were on Thursday in a negative territory after the announcement of the President of the United States, Donald Trump, of 26% rates in the country’s exports to the United States. Nifty 50 It dropped by 0.17%, while the largest BSE Index had dropped by 0.32% at 11:55 hours at local time.

Both rates have declined since the beginning of the year, with the Nifty 50 dropped by 1.56% and the BSE Sensex is 2.25% lower.

Ten -year -old Indian government performance increased slightly to 6,490%.

At CNBC TV this week, Vivian Thurston, a portfolio of William Blair’s portfolio, said that India has one of the highest commercial superplicators with the United States. The impact of rates on economic growth will not be substantialSaid Thurston.

What happens next week?

The Indian Reserve Bank will conclude the monetary policy meeting on Wednesday, when interest rates are expected to decrease. The United States and China Consumer Price Index will end the next day, presenting investors where the rates are headed in these countries.

April 4: United States non -agricultural payroll for MarchPresident of the Federal Reserve Jerome Powell Speech, India HSBC Composite Purchase Manager Index of March, Final Reading

April 9: Decision of the interest rate of India, Japan Confidence to the Consumer for March

April 10: North -American Consumer Price Index for MarchMinute of the United States Open Market Committee for March, Consumer and China Producer Indexes for March, Japan Producer Price Index for March

Leave a Reply